Elevating the Voice of B2B Customers

in Order Management Systems

Company: IBM

Timeline: 11 months

Date: February - December, 2024

Industry: Supply Chain

Background

I joined IBM's Order Management System (OMS) product team as the Lead UX Researcher at the beginning of 2024, after the team had been without any UX resources for over a year. Leading on a net new team of 5 UX Designers, 3 Content Designers, and myself as UXR, we faced the challenge of lack of trust to even access customers let alone engage users.

My task was to build new and mend broken stakeholder relationships in order for our discovery phase to succeed on the following research objectives:

Understand new and existing personas—especially the Account Manager—to identify unmet needs and adoption barriers in the B2B space.

Evaluate how B2B and B2C customers use OMS across the product lifecycle to uncover opportunities for revenue growth.

Strengthen stakeholder alignment by grounding product strategy in real customer insights rather than assumptions.

Project Overview

This project tells the 'zero to hero' story, over one year, of how I led the OMS Design Research team to contribute to 2 new logos in the B2B space (contracts worth $2million p/year for 3-5 years).

The story is broken into 3 stages that explains how this was achieved by:

Increasing customer engagements across the product development lifecycle (PDLC)

Designing interactive workshops and research activities that excite customers and align teams

Delivering deep quality insights that shaped direction, informed product design decisions, and ultimately increased revenue.

#1

Increasing Customer Engagement

across the PDLC

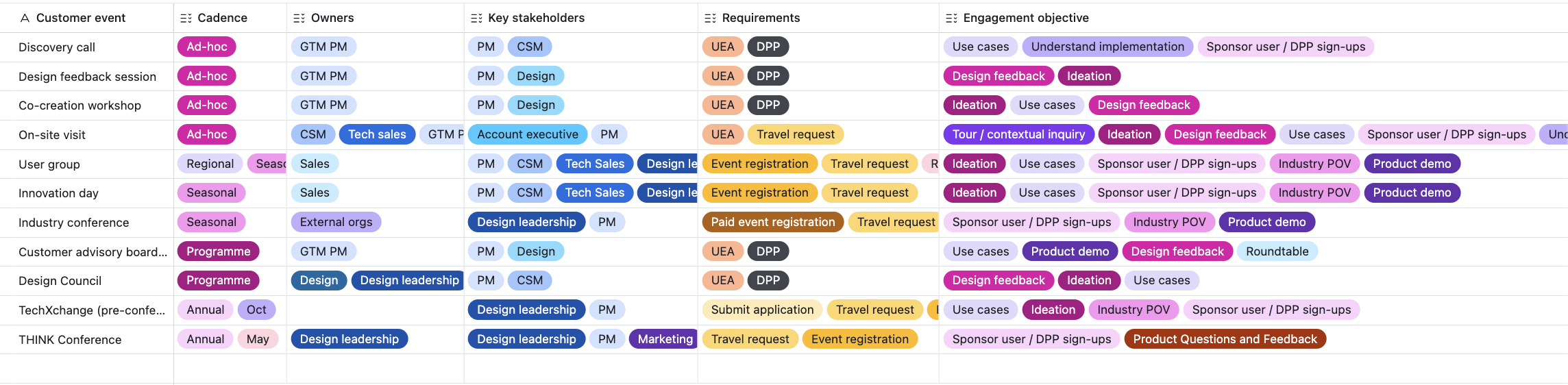

Understanding customer engagement channels

A common issue for Design accessing customer users is that we only found out about events or opportunities too late or after the fact. To plan a customer-centric research program, we needed to understand existing customer engagement channels.

Therefore, my first step was to create a shared view and discuss with GTM PMs and Design leadership what customer events are happening, how far in advance they’re planned, what research activities are appropriate for each, requirements to attend, owners for each, and how to get buy in.

Finding an opportunity to catalyse change

From that exercise, we identified an upcoming in-person User Group event that was struggling with low engagement in the EMEA region. I ran a 1 hour workshop focused on:

interactive design thinking activities to increase customer input

ideation between customers vs a product management 'validation exercise'

Not only did it increase customer interaction and interest in future research, but it also gained the trust of our team of Sales, GTM and Product teams that Design & Research are key to connecting the dots between insight and opportunities for growth.

(More on workshop process & insights below).

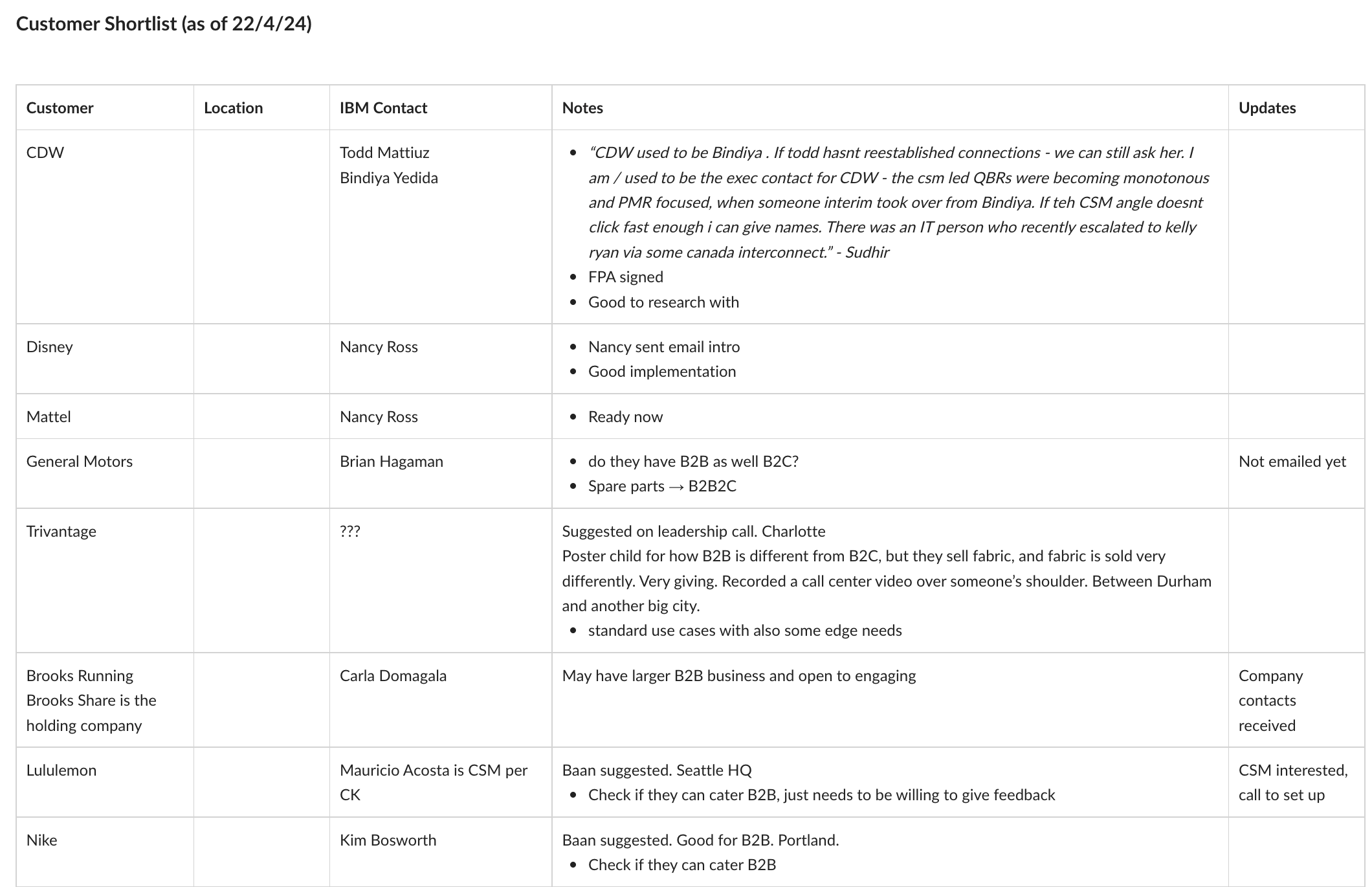

Building a research program aligned with stakeholders & customers

With this rebuilt trust from the User Group workshop, stakeholders and customers were more open to participating in on-site visits and feedback sessions.

With input from CSM, PM and Design leadership, I shortlisted customers based on: the nature of their B2B use cases, stage of product implementation, customer relationship status and readiness to engage.

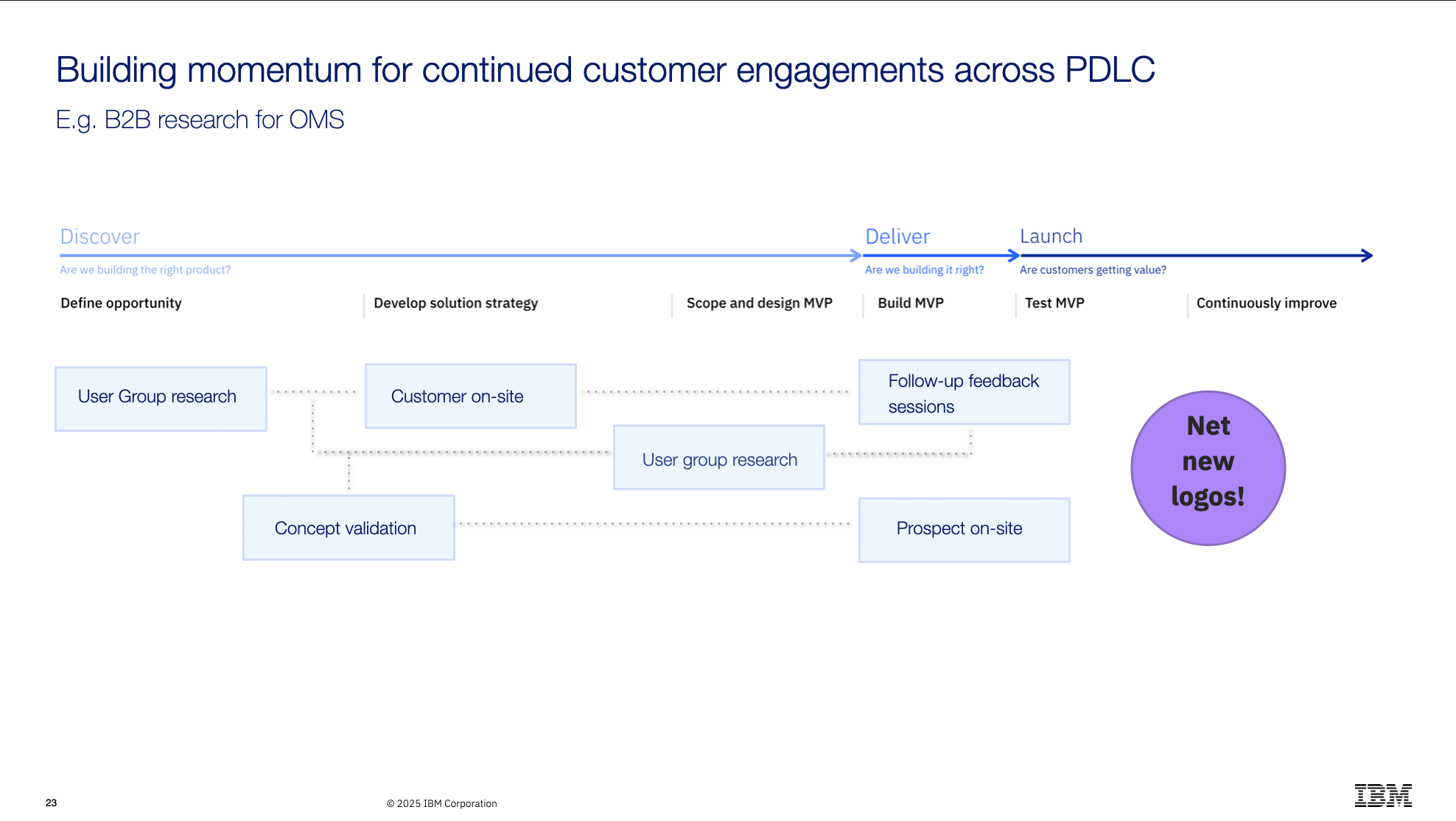

This targeted outreach and alignment with CSM resulted in the following research program of six key research engagements throughout the PDLC.

1 Year Research Program

To rebuild trust and create continuous customer engagement, we ran six research engagements across the PDLC, moving from discovery to launch:

User group research to uncover baseline customer needs

Customer on‑site sessions to observe real workflows

Concept validation to test early ideas and de‑risk investment

Prospect and customer feedback loops during MVP design

Follow‑up usability and workflow sessions as the MVP matured

Launch‑stage testing to ensure customers gained real value

This continuous cadence strengthened relationships, informed product decisions at every stage.

Building momentum from that first User Group opportunity acted as catalyst for further engagements, as I had:

key contacts to follow up with

established a research-led prospect relationship

teased customers with 'sneak previews' of new designs to review in concept validation sessions

Why is continuous customer engagement so important? Because it enabled us to iterate on feedback, increase our level of confidence, and improve our GTM strategy based on market input.

#2

Designing interactive workshops and research

Workshop Planning

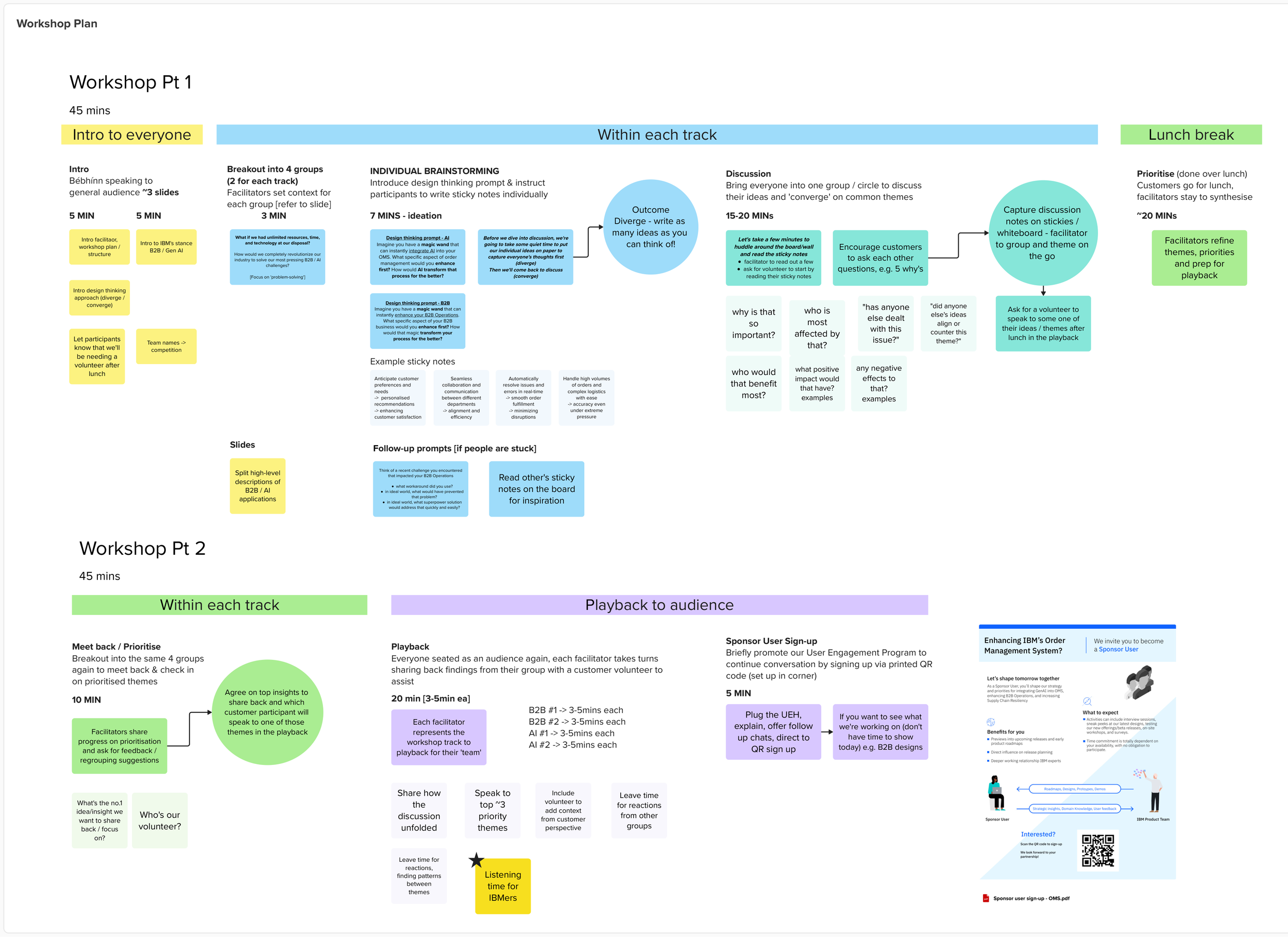

My approach to planning at scale is grounded in designing for clarity, participation equity, and synthesis under time constraints. For large groups (~70 participants across 4 tracks), I plan workshops as parallel systems rather than a single linear session: clear tracks, consistent facilitation mechanics, and tightly time-boxed activities. By creating a structured Mural in advance, this enabled non-Design facilitators to guide groups with confidence and consistency.

Individual ideation always precedes group discussion to avoid groupthink, while prompts and examples ensure participants who are less familiar with design thinking can still contribute meaningfully.

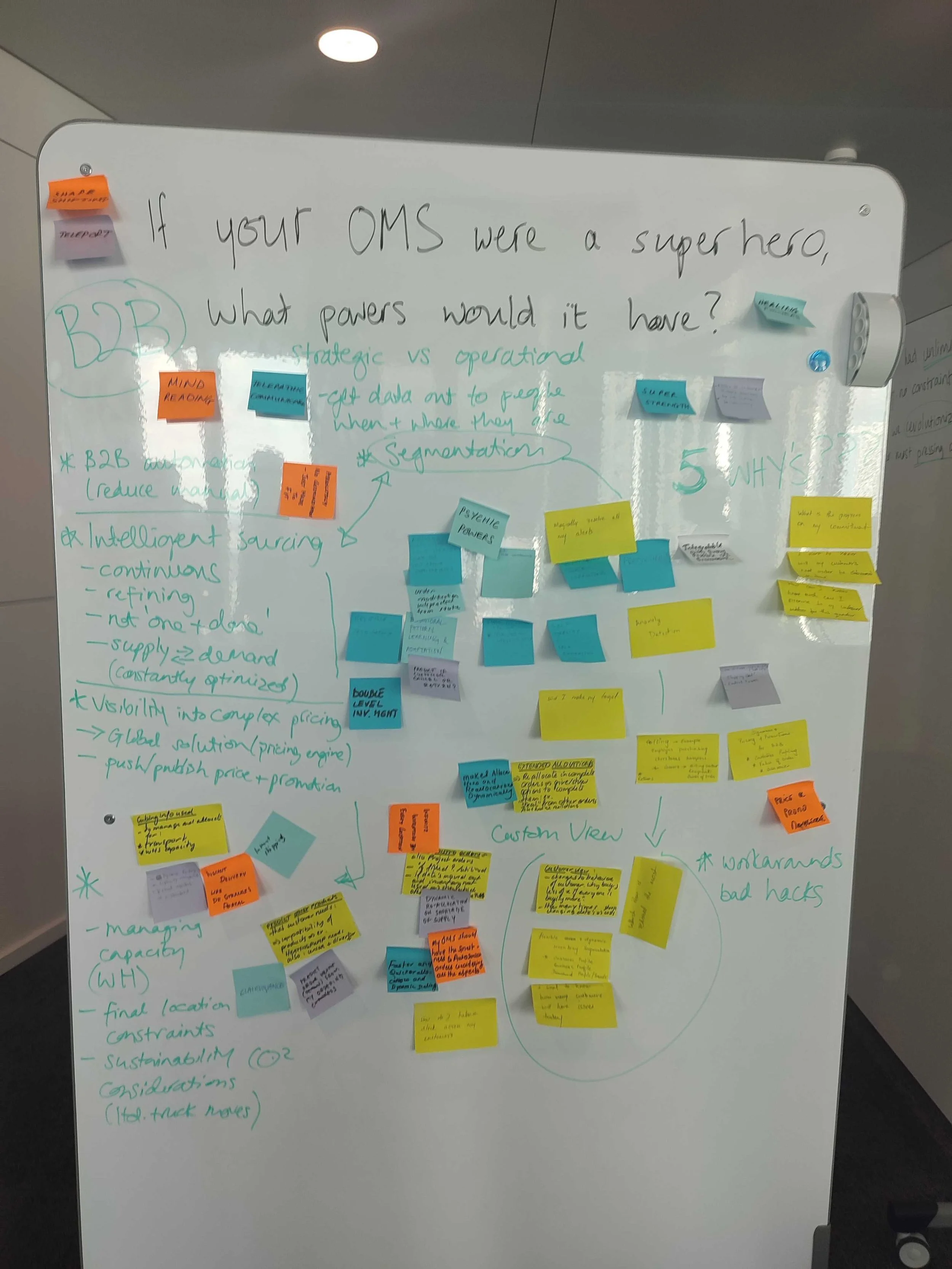

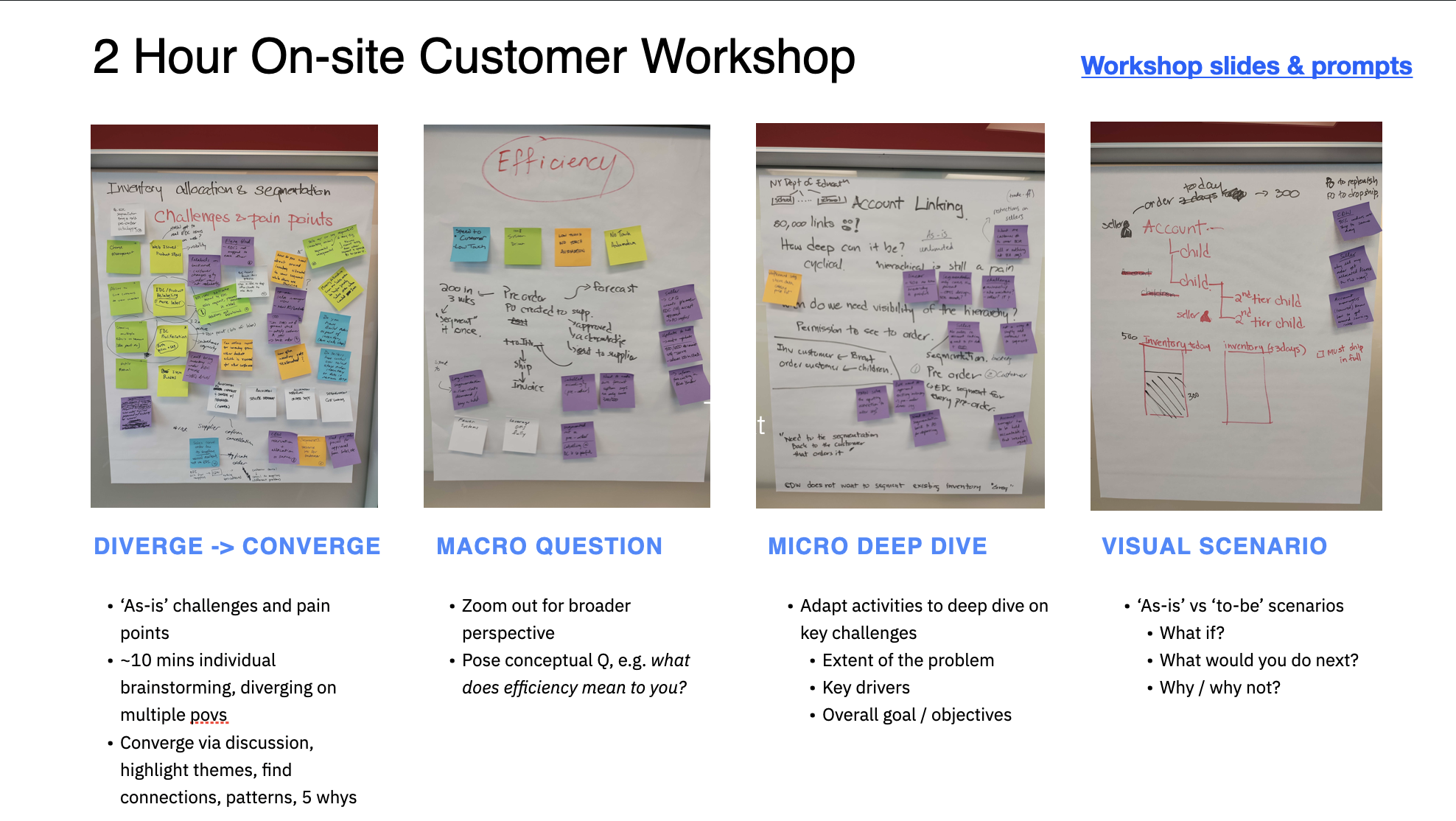

The 'Mechanics' of a B2B Workshop

A strong workshop balances exploration with decision-oriented outcomes. In a two-hour on-site format, I deliberately moved participants through phases of diverge → converge → prioritise → validate. Activities progressed from surfacing current-state pain points, to reframing the problem at a macro level, to focused deep dives on the most critical challenges.

Visual scenarios and 'as-is / to-be' exercises helped participants externalise complex operational logic, while facilitation techniques such as '5 Whys' ensure discussions remain grounded in real constraints, trade-offs, and business goals..

Synthesising Across Research Engagements

Workshops are not treated as standalone events but as sense-making nodes within a broader research programme. I planned workshops to intentionally connect with insights from interviews, on-site research, user groups, and concept validation, using them to stress-test emerging themes and build shared understanding across customers and internal teams.

Synthesis happens both in-room (through prioritisation and playback) and post-workshop, where patterns are integrated into the wider research narrative to inform product direction, roadmap decisions, and stakeholder alignment.

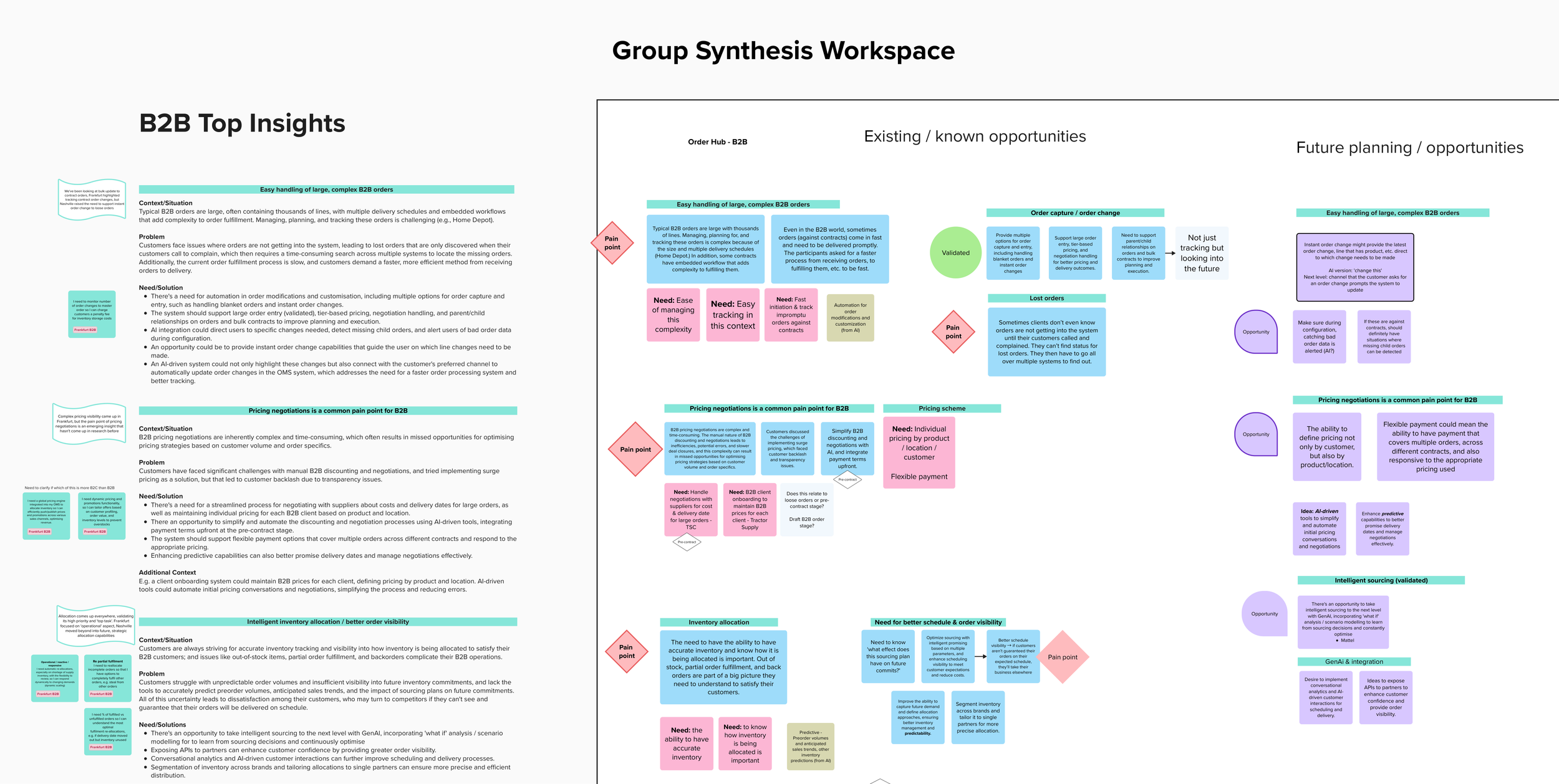

Emerging Insights

Complex account hierarchies and segmentation logic are a major blocker to adoption of allocation and segmentation features

Supporting Findings & Insights

Account linking across tens of thousands of customers creates operational blind spots

Segmentation is used tactically (same-day reserve), not as long-term static rules

Parent-only segmentation does not reflect how customers operate in reality

Financial and PO integration is essential for segmentation to be viable

Impact on roadmap: Reframed ‘segmentation’ as a temporary, operational tool, not a static configuration feature.

B2B pricing is highly manual, negotiated, and opaque — creating inefficiencies and customer trust risks

Supporting Findings & Insights

Pricing varies by customer, product, volume, and location

Negotiations with suppliers are time-consuming and poorly supported by tooling

Attempts to automate pricing (e.g. surge pricing) caused customer backlash

Customers want flexible payment terms defined earlier in the contract process

Impact on roadmap: Surfaced B2B-specific pricing needs not currently represented in the product roadmap.

Prospect research validated core operational value while exposing gaps critical to sales execution and scalability

Supporting Findings & Insights

Strong positive reaction to fulfilment issue visibility and drill-downs

Sales teams need:

Aggregated views across accounts

Real-time alerts for shipment delays

History of delivery date changes

Release orders are the primary execution unit, not contract orders

Impact on growth: Validated product direction while identifying sales-critical gaps influencing deal confidence.

#3 Delivering Deep Quality Insights

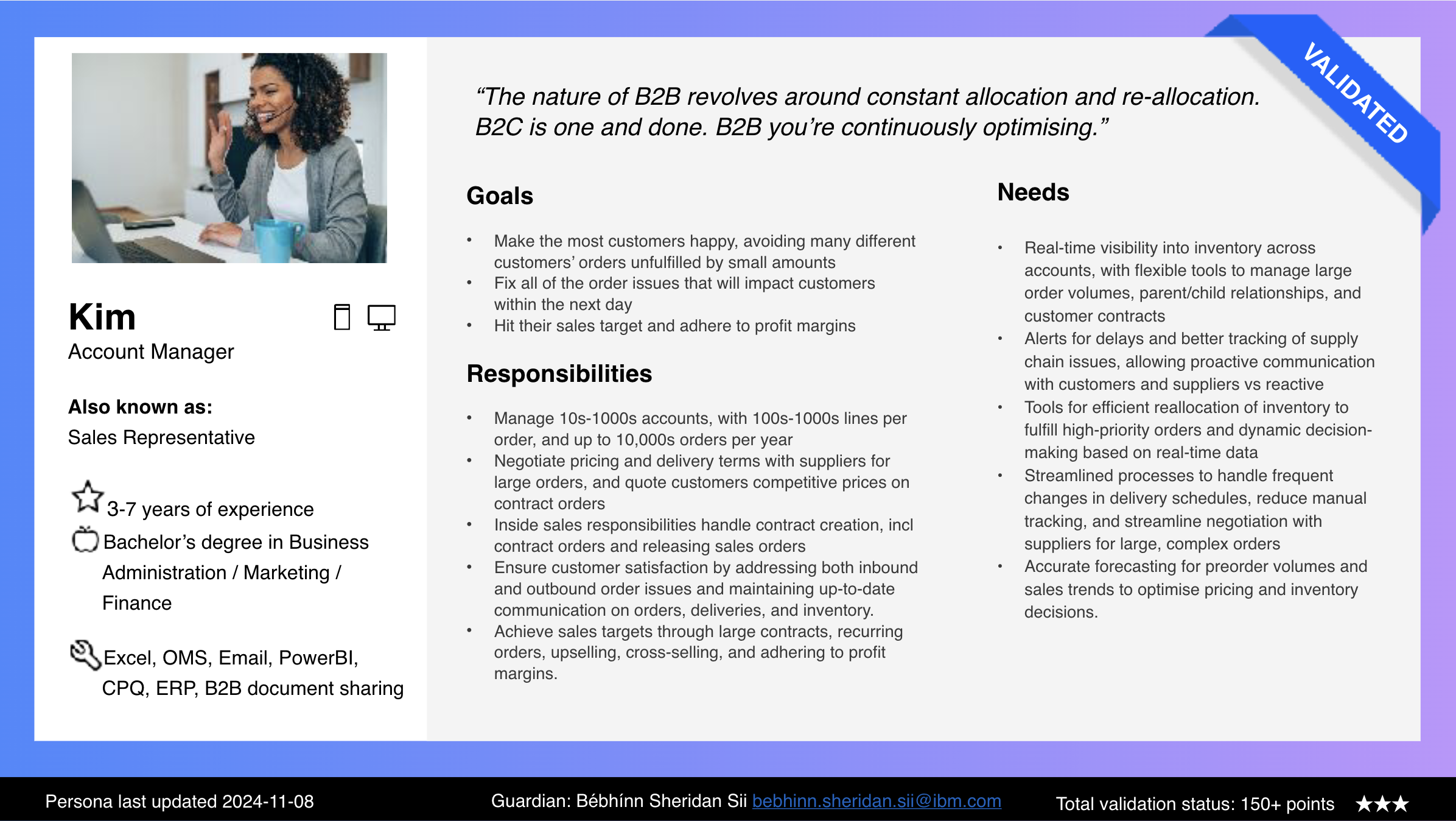

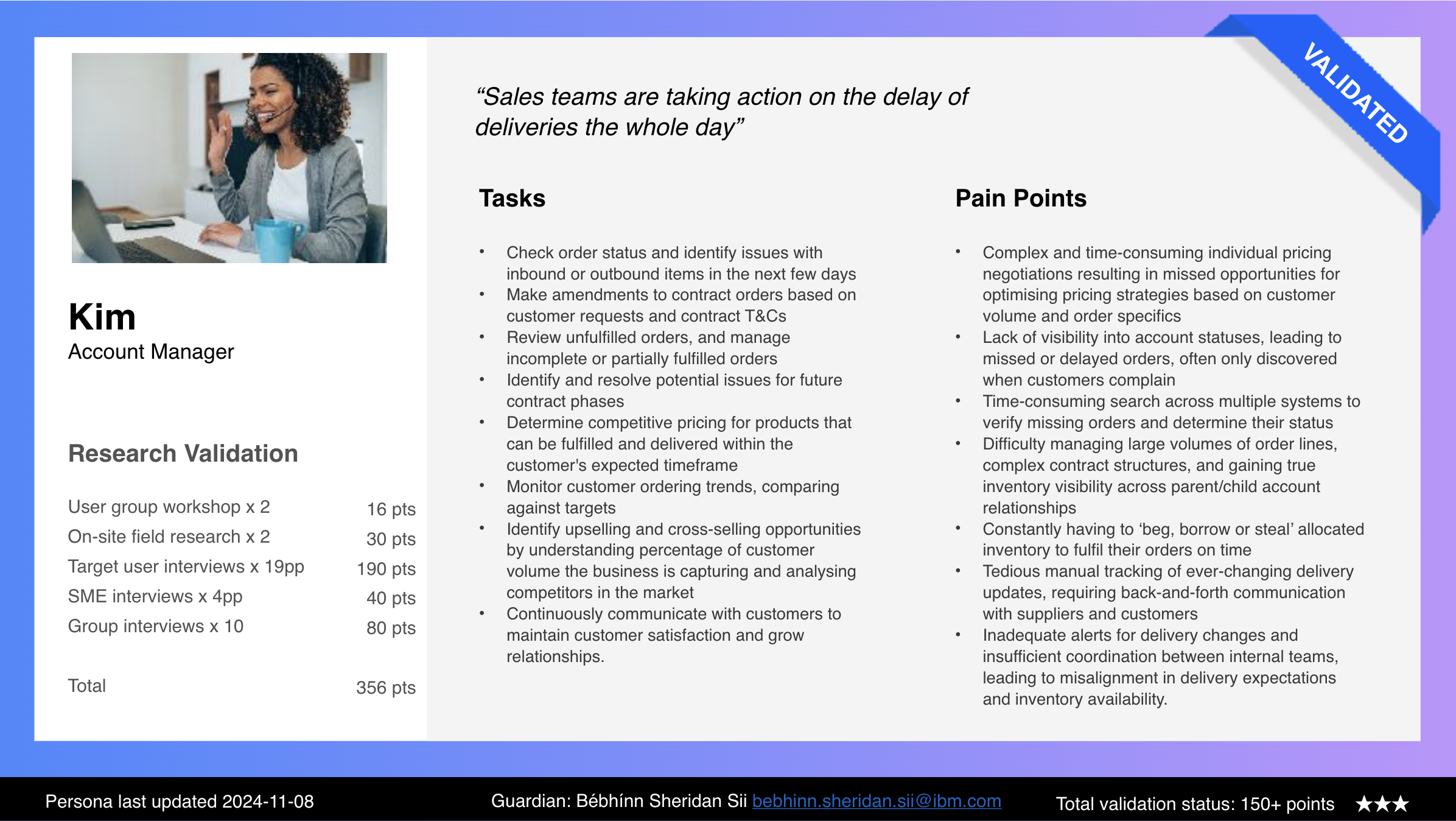

New Persona: Kim, the Account Manager

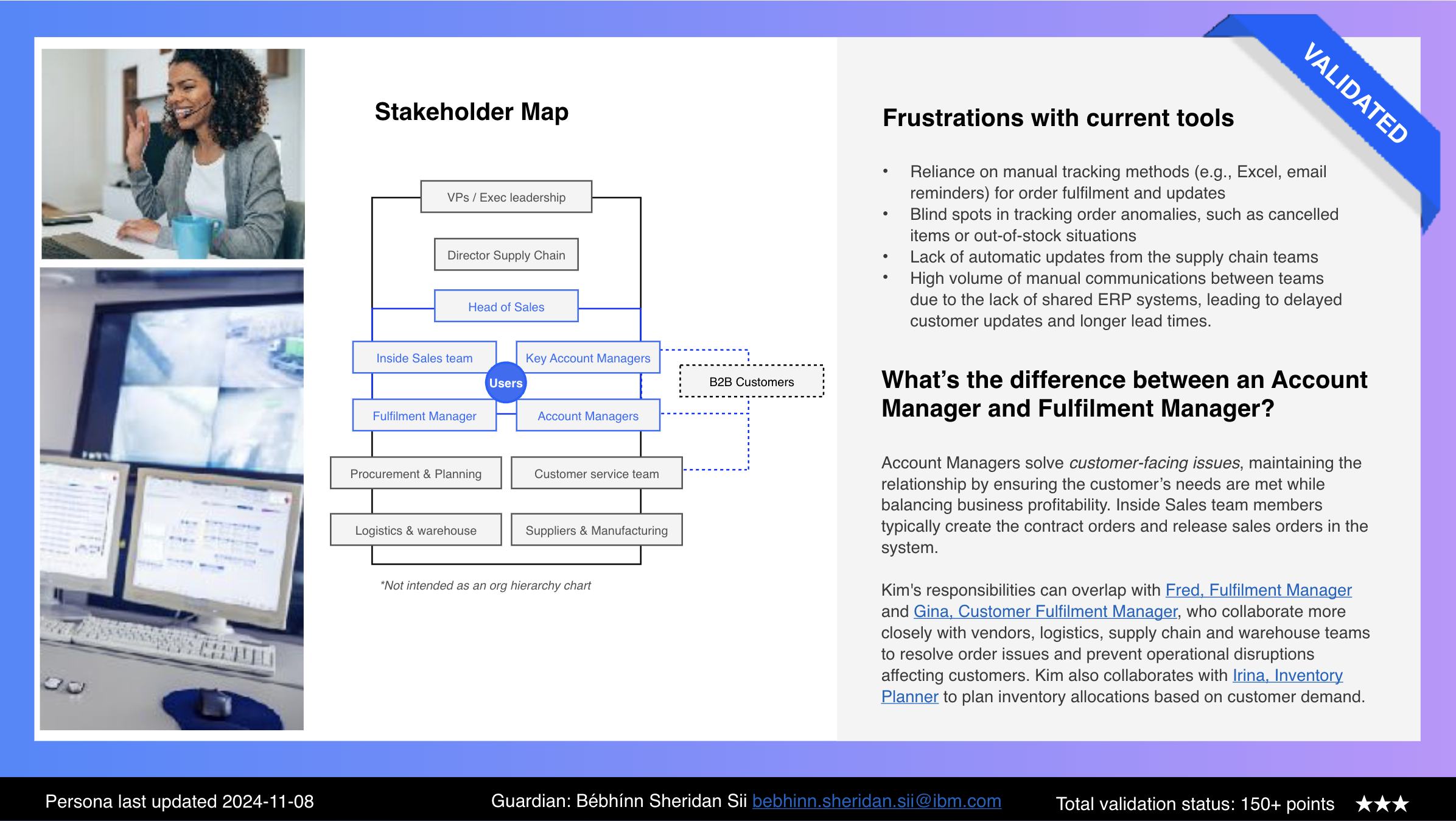

Research reframed the team’s understanding of the primary user, from a high-level ‘Fulfilment Manager’ to a Sales Account Manager operating within a target-driven sales environment.

Creating Kim, the Account Manager — the team’s first B2B persona — surfaced a fundamentally different set of motivations and pressures than the supply-chain-focused personas the team had previously designed for, revealing that this role is shaped not only by fulfilment execution, but by sales targets, customer relationships, and constant trade-offs between competing accounts.

This persona artefact and insights helped IBM's Sales and GTM teams to lead prospect conversations with empathy, speaking to how our enhanced solution can meet their specific needs to continuously optimise allocation decisions under supply constraints to meet their quarterly and yearly targets.

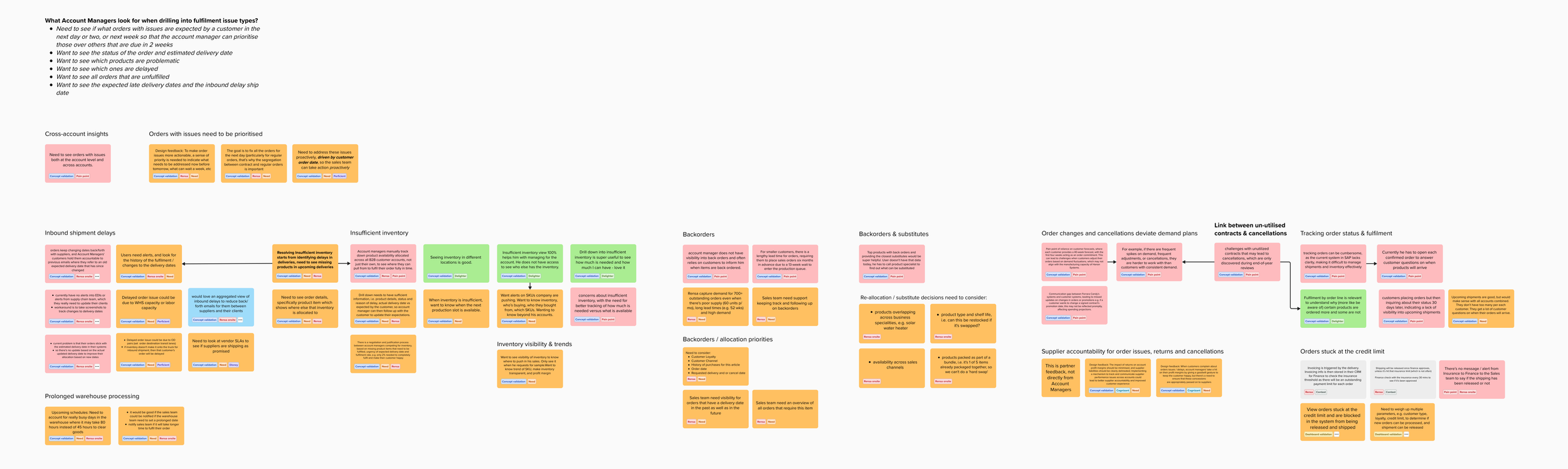

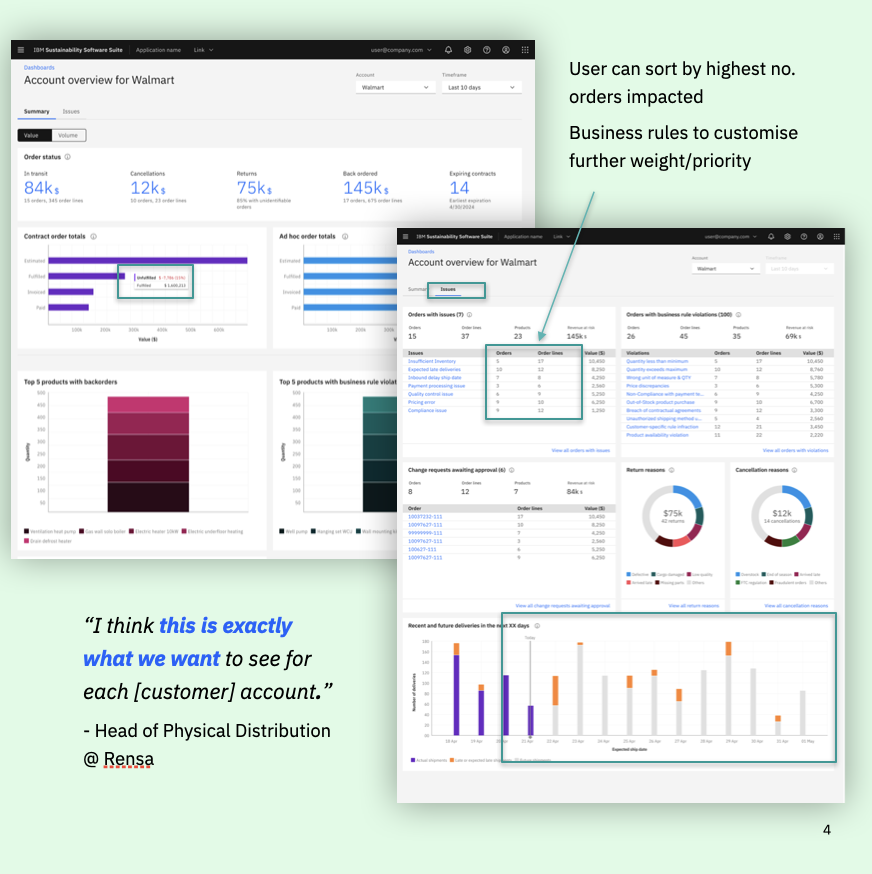

Daily B2B usage is driven by operational problem-solving, not historical reporting — dashboards must surface what needs action today

Supporting Findings & Insights

Account managers prioritise unfulfilled and partially fulfilled orders over retrospective performance data

% unfulfilled is the first signal they look for when opening an account

Users need clear prioritisation cues (today vs tomorrow vs next week) to take action quickly

Sorting by “orders impacted” enables faster triage across accounts

Impact on design: Shifted the new feature focus toward a Single Account Operational Dashboard optimised for action, not review.

Insight to Action

Persona insights and research insights from B2B customer engagements were translated into concrete design recommendations and concept iterations, aligning product direction with users’ operational realities and highest-impact decision points.

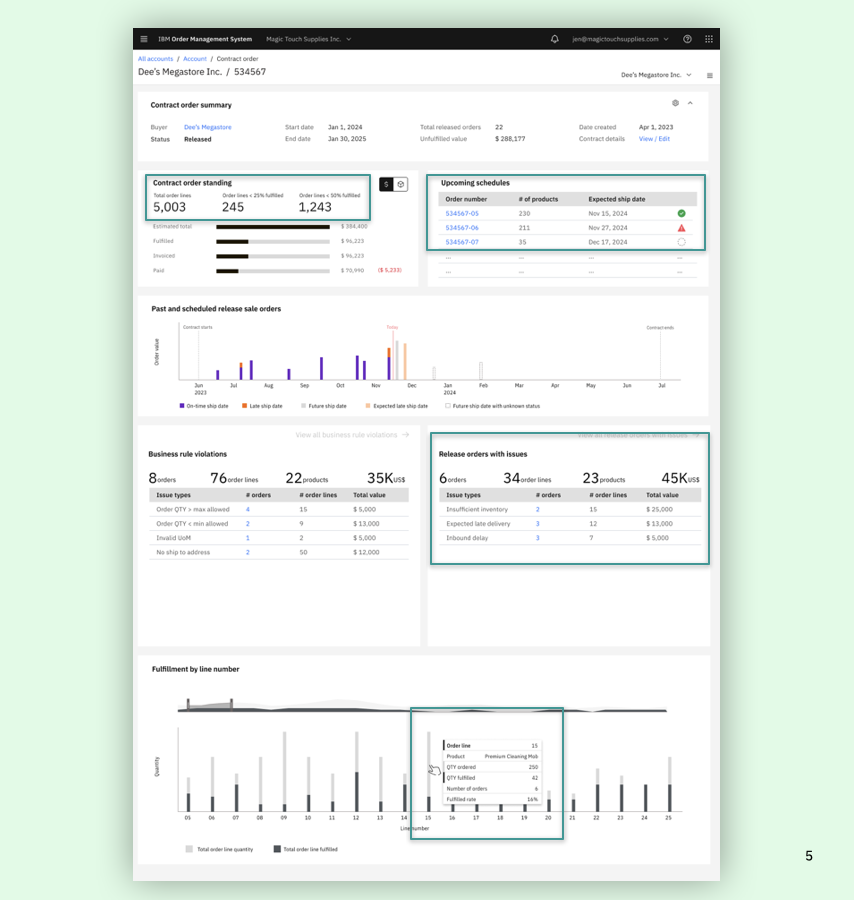

Actionable order visibility is critical to decision-making — users need fast answers to status, delays, and risk.

Supporting Findings & Insights

Core questions users repeatedly ask:

What’s delayed?

What’s unfulfilled or partially fulfilled?

When will it arrive?

Users manage delivery exceptions continuously throughout the day

Lack of consolidated views forces manual tracking and context-switching

Impact on design: Reinforced the need for a Contract Order Summary that aggregates fulfilment risk and status in one place

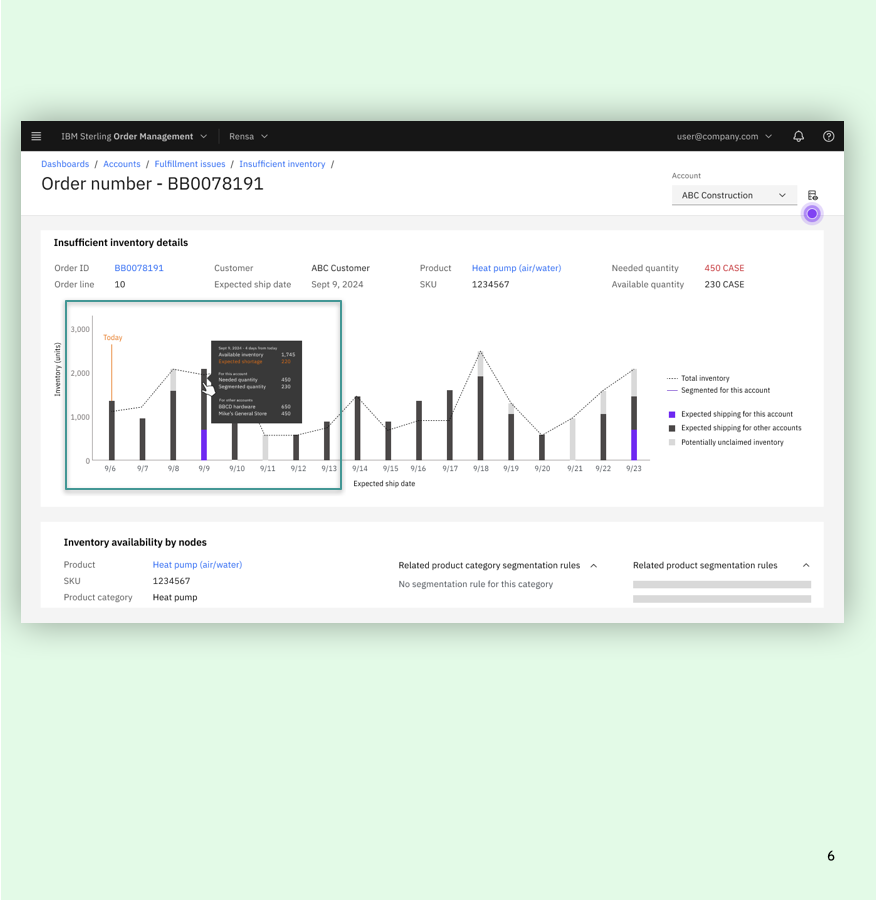

There is a structural tension between sales goals and account-level fulfilment goals that systems must actively support.

Supporting Findings & Insights

Sales teams optimise for overall customer happiness; account managers optimise for their own orders

Account managers manually search across accounts to rebalance inventory

Inventory allocation decisions involve negotiation, justification, and urgency assessment

Current tooling does not support this decision logic explicitly

Impact on design: Identified opportunity for cross-account inventory visibility and prioritisation logic that reflects real decision-making.

Project Outcomes

New IBM Logos

Over the course of one year, this research programme rebuilt trust with internal stakeholders and customers, re-establishing UX research as a credible driver of product and commercial outcomes within OMS.

By grounding discovery in the needs of a newly prioritised B2B persona—the Account Manager—research insights directly informed product direction, design decisions, and go-to-market conversations.

The resulting personas and evidence-based recommendations enabled Sales and GTM teams to engage prospects with greater empathy and relevance, contributing to the acquisition of two new B2B customers (Crocs and Rensa) and securing contracts worth approximately $2M per year over multi-year terms.